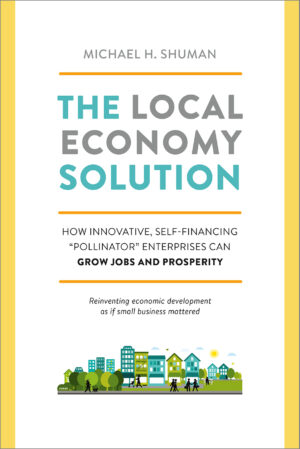

The Local Economy Solution

How Innovative, Self-Financing "Pollinator" Enterprises Can Grow Jobs and Prosperity

The Local Economy Solution

How Innovative, Self-Financing "Pollinator" Enterprises Can Grow Jobs and Prosperity

Reinventing economic development as if small business mattered

In cities and towns across the nation, economic development is at a crossroads. A growing body of evidence has proven that its current cornerstone—incentives to attract and retain large, globally mobile businesses—is a dead end. Even those programs that focus on local business, through buy-local initiatives, for example, depend on ongoing support from government or philanthropy. The entire practice of economic development has become ineffective and unaffordable and is in need of a makeover.

The Local Economy Solution suggests an alternative approach in which states and cities nurture a new generation of special kinds of businesses that help local businesses grow. These cutting-edge companies, which Shuman calls “pollinator businesses,” are creating jobs and the conditions for future economic growth, and doing so in self-financing ways.

Pollinator businesses are especially important to communities that are struggling to lift themselves up in a period of economic austerity, when municipal budgets are being slashed. They also promote locally owned businesses that increase local self-reliance and evince high labor and environmental standards.

The book includes nearly two dozen case studies of successful pollinator businesses that are creatively facilitating business and neighborhood improvements, entrepreneurship, local purchasing, local investing, and profitable business partnerships. Examples include Main Street Genome (which provides invaluable data to improve local business performance), Supportland (which is developing a powerful loyalty card for local businesses), and Fledge (a business accelerator that finances itself through royalty payments). It also shows how the right kinds of public policy can encourage the spread of pollinator businesses at virtually no cost.

Reviews and Praise

Choice-

"Shuman is an economist, an attorney, and the author of three other books on local economies. This most recent book is a practical overview of how to generate economic development without selling one's soul to big government and philanthropies. Shuman developed the book from interviews he conducted in 2014 with entrepreneurs who headed up 36 ‘pollinators,' defined as 'self-financing enterprise[s] committed to boosting local business.’ A pollinator allows a community to take on key economic development functions: identifying opportunities for local businesses (the planning), fostering buy efforts (the purchasing), training locals for business opportunities (the people), showing how local businesses can work together (the partnerships), and finding how local capital can be mobilized to expand local businesses more cost-effectively than taxpayer-funded programs can (the purse). Shuman urges readers and their friends to form local investment clubs; such clubs essentially make members part of the solution because they help those interested in joining the movement move away from 'legalized bribery,' such as offering companies tax breaks to abandon their hometowns. Taken as a whole, this book presents an engaging story of the emerging localization movement by describing real people and enterprises doing real development. Summing Up: Recommended. Lower-division undergraduates through professionals and practitioners.”

More Reviews and Praise

Kirkus Reviews-

"An argument against bringing large corporations to local communities through tax incentives and grants, an approach the author claims is destructive to employment and investment. Shuman (Local Dollars, Local Sense: How to Move Your Money From Wall Street to Main Street and Achieve Real Prosperity, 2012, etc.), a longtime advocate for promoting local business and a former director of the Business Alliance For Local Living Economies, asserts that "economic development today is completely broken." Citing the 750-fold increase in subsidies for the movie industry over the past decade, the author debunks the myths circulated to support attracting business in this way, and he argues that such deals do not create jobs but rather take more money out of communities than they bring in. He insists that "those who win the investment lose" and that "it's high time for economic developers to get back to business." Shuman views local startup businesses as the answer, especially the kind he calls "pollinators." These measure success more broadly than by direct returns and include significant contributions to their community and other local businesses. This approach is intended to strengthen a core feature of the current economy. "All companies that matter," he writes, "are not globally mobile." More than half are not spreading across the world but are locally owned and unlikely to move. U.S. capital markets do not often invest in local businesses. Self-financing local "pollinators" address this "huge capital market failure." Shuman believes that planners should focus on the potentials within their areas through the accumulation of the detailed knowledge necessary, and he provides ways to measure opportunities lost and potential foregone. He also discusses profiles from several cities and counties to exemplify ways in which local businesses are being promoted. These include Sustainable Connections in Bellingham, Washington, and Local First Arizona, among others. A practical overview of the untapped potentials of a substantial part of the economy."

“Michael Shuman, long a pioneer in the local-economy movement, has pushed the conversation forward once again, showcasing new tools for localists, new business models for entrepreneurs, and new development strategies for economic planners. A terrific resource for cash-strapped communities building wealth and resilience from the ground up.”--Judy Wicks, author of Good Morning, Beautiful Business, cofounder of BALLE, and founder of the White Dog Café

"Michael Shuman has done it again. In The Local Economy Solution, he shreds the conventional wisdom about economic development and local business initiatives that rely on grants. His Rx: self-financing “pollinator” businesses. This one is sure to make some waves!”--Amy Cortese, author of Locavesting: The Revolution in Local Investing and How to Profit From it

"Shuman’s book is critically important to anyone who cares about genuine economic development. Neither left nor right politically, it’s positive and encouraging, while confronting head-on the challenges of the approach he has advocated for years. Unlike many economic development books that can be tedious, this one is engaging, even fun to read, like a good story told over a beer – but a practical story that will help communities reach a resilient future."--Michael Kinsley, manager, Rocky Mountain Institute

"Shuman's many followers in the new economics movement will relish this latest offering for its focused message, compelling stories, and coherent vision. He embodies the Gandhian dictum to both see the change and be it. Readers new to his work will be appalled to learn of the "counterproductive and corrupting" practices in mainstream economic development, and relieved to encounter the creative entrepreneurs who are "pollinating" the spread of locally rooted alternatives."--Diana Chapman Walsh, president emerita, Wellesley College

"Another blockbuster treatise on can-do, localized entrepreneurism. Shuman is a master.”--Joel Salatin, Polyface Farm

"Michael Shuman pulls no punches in his biting review of local contemporary economic development. Every thoughtful practitioner, whether agreeing with his critique or not, must seriously consider Shuman’s nuanced approach to growing local economies through 'pollinator' enterprises."--Robert Jaquay, The George Gund Foundation

"The emerging localization movement owes a huge debt of gratitude to Michael Shuman. A visionary thinker with decades of hard-won, grassroots experience, he offers not only a clear picture of a very different economic landscape but the steps we need to take—as individuals and as communities—to move from here to there."--Helena Norberg-Hodge, founder and director of Local Futures and producer and co-director of The Economics of Happiness

"The Local Economy Solution is Shuman at his best. Using language accessible to lay people and policy makers alike, Shuman explains why the standard model of economic development is flawed and goes into detail, with many examples, about better ways to build local economies. This should be mandatory reading for planners and business people across the country. "--Chris Morrow, Northshire Bookstores

"First rate! Cutting-edge strategies for community-sustaining business development without bribing big corporations—by one of the nation’s leading and most creative localists!”--Gar Alperovitz, author of What Then Must We Do? Straight Talk About the Next American Revolution

"Michael Shuman’s first book showed us a vision of community economics and empowerment; his latest book, The Local Economy Solution, examines some of the best examples of community-based enterprise as he teaches us how to bring vision to reality. An excellent and welcome addition to my library that builds on Michael’s extraordinary expertise and insights."--Jed Emerson, coauthor, The Impact Investor: Lessons in Leadership and Strategy for Collaborative Capitalism

"I have been impressed by Michael Shuman for a long time, but The Local Economy Solution sent my admiration soaring. He shows the genuine myopia and "legal corruption" of the prevailing model of state and local economic development, then he explains the new localist model taking hold in many enlightened communities; and, best of all, he brings his engaging writing skills to describing the real people and enterprises that are bringing this model to life. His book is both an inspiration and a handbook for doing real development.”--James Gustave Speth, author of America the Possible: Manifesto for a New Economy and Angels by the River: A Memoir

"Michael Shuman is a pioneering voice for an economic development model that is sustainable and truly democratic. I've read all his books and this is the best one yet. Do yourself a favor and absorb his brilliance."--Kevin Danaher, cofounder of Global Exchange, Green Festivals, and Fair Trade USA

"Michael Shuman is the world’s most knowledgeable cheerleader and observer of efforts to promote local economies, and each of his books offers essential, practical information to advance the cause. In The Local Economy Solution, he shines light on new models of local economic development that are self-financing—an all-important innovation, given that many localist efforts currently depend on subsidies and grants. If you have any interest in furthering your region’s economic resilience, this brilliant, clear book should be at the very top of your reading list."--Richard Heinberg, senior fellow, Post Carbon Institute

Reviews and Praise

Choice-

"Shuman is an economist, an attorney, and the author of three other books on local economies. This most recent book is a practical overview of how to generate economic development without selling one's soul to big government and philanthropies. Shuman developed the book from interviews he conducted in 2014 with entrepreneurs who headed up 36 ‘pollinators,' defined as 'self-financing enterprise[s] committed to boosting local business.’ A pollinator allows a community to take on key economic development functions: identifying opportunities for local businesses (the planning), fostering buy efforts (the purchasing), training locals for business opportunities (the people), showing how local businesses can work together (the partnerships), and finding how local capital can be mobilized to expand local businesses more cost-effectively than taxpayer-funded programs can (the purse). Shuman urges readers and their friends to form local investment clubs; such clubs essentially make members part of the solution because they help those interested in joining the movement move away from 'legalized bribery,' such as offering companies tax breaks to abandon their hometowns. Taken as a whole, this book presents an engaging story of the emerging localization movement by describing real people and enterprises doing real development. Summing Up: Recommended. Lower-division undergraduates through professionals and practitioners.”

Kirkus Reviews-

"An argument against bringing large corporations to local communities through tax incentives and grants, an approach the author claims is destructive to employment and investment. Shuman (Local Dollars, Local Sense: How to Move Your Money From Wall Street to Main Street and Achieve Real Prosperity, 2012, etc.), a longtime advocate for promoting local business and a former director of the Business Alliance For Local Living Economies, asserts that "economic development today is completely broken." Citing the 750-fold increase in subsidies for the movie industry over the past decade, the author debunks the myths circulated to support attracting business in this way, and he argues that such deals do not create jobs but rather take more money out of communities than they bring in. He insists that "those who win the investment lose" and that "it's high time for economic developers to get back to business." Shuman views local startup businesses as the answer, especially the kind he calls "pollinators." These measure success more broadly than by direct returns and include significant contributions to their community and other local businesses. This approach is intended to strengthen a core feature of the current economy. "All companies that matter," he writes, "are not globally mobile." More than half are not spreading across the world but are locally owned and unlikely to move. U.S. capital markets do not often invest in local businesses. Self-financing local "pollinators" address this "huge capital market failure." Shuman believes that planners should focus on the potentials within their areas through the accumulation of the detailed knowledge necessary, and he provides ways to measure opportunities lost and potential foregone. He also discusses profiles from several cities and counties to exemplify ways in which local businesses are being promoted. These include Sustainable Connections in Bellingham, Washington, and Local First Arizona, among others. A practical overview of the untapped potentials of a substantial part of the economy."

“Michael Shuman, long a pioneer in the local-economy movement, has pushed the conversation forward once again, showcasing new tools for localists, new business models for entrepreneurs, and new development strategies for economic planners. A terrific resource for cash-strapped communities building wealth and resilience from the ground up.”--Judy Wicks, author of Good Morning, Beautiful Business, cofounder of BALLE, and founder of the White Dog Café

"Michael Shuman has done it again. In The Local Economy Solution, he shreds the conventional wisdom about economic development and local business initiatives that rely on grants. His Rx: self-financing “pollinator” businesses. This one is sure to make some waves!”--Amy Cortese, author of Locavesting: The Revolution in Local Investing and How to Profit From it

"Shuman’s book is critically important to anyone who cares about genuine economic development. Neither left nor right politically, it’s positive and encouraging, while confronting head-on the challenges of the approach he has advocated for years. Unlike many economic development books that can be tedious, this one is engaging, even fun to read, like a good story told over a beer – but a practical story that will help communities reach a resilient future."--Michael Kinsley, manager, Rocky Mountain Institute

"Shuman's many followers in the new economics movement will relish this latest offering for its focused message, compelling stories, and coherent vision. He embodies the Gandhian dictum to both see the change and be it. Readers new to his work will be appalled to learn of the "counterproductive and corrupting" practices in mainstream economic development, and relieved to encounter the creative entrepreneurs who are "pollinating" the spread of locally rooted alternatives."--Diana Chapman Walsh, president emerita, Wellesley College

"Another blockbuster treatise on can-do, localized entrepreneurism. Shuman is a master.”--Joel Salatin, Polyface Farm

"Michael Shuman pulls no punches in his biting review of local contemporary economic development. Every thoughtful practitioner, whether agreeing with his critique or not, must seriously consider Shuman’s nuanced approach to growing local economies through 'pollinator' enterprises."--Robert Jaquay, The George Gund Foundation

"The emerging localization movement owes a huge debt of gratitude to Michael Shuman. A visionary thinker with decades of hard-won, grassroots experience, he offers not only a clear picture of a very different economic landscape but the steps we need to take—as individuals and as communities—to move from here to there."--Helena Norberg-Hodge, founder and director of Local Futures and producer and co-director of The Economics of Happiness

"The Local Economy Solution is Shuman at his best. Using language accessible to lay people and policy makers alike, Shuman explains why the standard model of economic development is flawed and goes into detail, with many examples, about better ways to build local economies. This should be mandatory reading for planners and business people across the country. "--Chris Morrow, Northshire Bookstores

"First rate! Cutting-edge strategies for community-sustaining business development without bribing big corporations—by one of the nation’s leading and most creative localists!”--Gar Alperovitz, author of What Then Must We Do? Straight Talk About the Next American Revolution

"Michael Shuman’s first book showed us a vision of community economics and empowerment; his latest book, The Local Economy Solution, examines some of the best examples of community-based enterprise as he teaches us how to bring vision to reality. An excellent and welcome addition to my library that builds on Michael’s extraordinary expertise and insights."--Jed Emerson, coauthor, The Impact Investor: Lessons in Leadership and Strategy for Collaborative Capitalism

"I have been impressed by Michael Shuman for a long time, but The Local Economy Solution sent my admiration soaring. He shows the genuine myopia and "legal corruption" of the prevailing model of state and local economic development, then he explains the new localist model taking hold in many enlightened communities; and, best of all, he brings his engaging writing skills to describing the real people and enterprises that are bringing this model to life. His book is both an inspiration and a handbook for doing real development.”--James Gustave Speth, author of America the Possible: Manifesto for a New Economy and Angels by the River: A Memoir

"Michael Shuman is a pioneering voice for an economic development model that is sustainable and truly democratic. I've read all his books and this is the best one yet. Do yourself a favor and absorb his brilliance."--Kevin Danaher, cofounder of Global Exchange, Green Festivals, and Fair Trade USA

"Michael Shuman is the world’s most knowledgeable cheerleader and observer of efforts to promote local economies, and each of his books offers essential, practical information to advance the cause. In The Local Economy Solution, he shines light on new models of local economic development that are self-financing—an all-important innovation, given that many localist efforts currently depend on subsidies and grants. If you have any interest in furthering your region’s economic resilience, this brilliant, clear book should be at the very top of your reading list."--Richard Heinberg, senior fellow, Post Carbon Institute