The Wild in Us and Us in the Wild

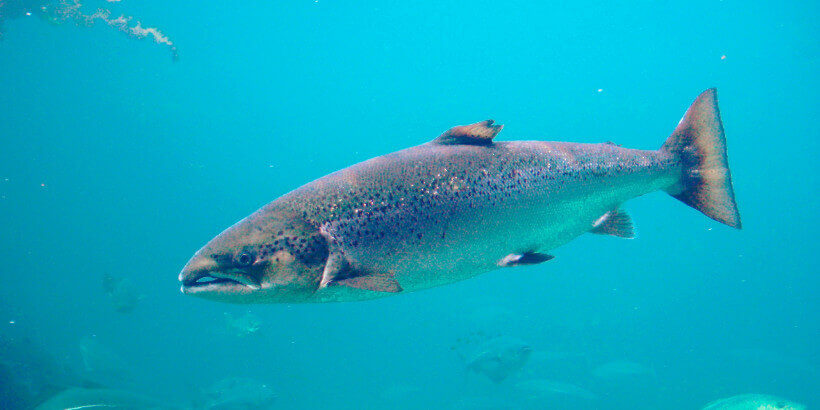

In the following Q&A, Martin Lee Mueller, author of Being Salmon, Being Human, discusses the importance of rethinking the human-Earth relationship, why salmon are the perfect creatures to start the conversation, and what we can do to give back.

Q: Part of your inspiration to write this book came from an opinion piece about the salmon industry in a Norwegian business newspaper. What struck you about that article?

A: A professor of fishery economics at a Norwegian business school wrote that the time had come to let Norway’s wild salmon go extinct. It may be an uneasy but inevitable choice, he wrote. The fish farming industry may be the number one threat to the wild salmon, but it had also become such an important motor of economic development that it was worth protecting at practically any cost. The loss of an entire species was a sacrifice, he suggested, that Norway absolutely should be willing to make. With my book, I wanted to stand up not only against the arrogance and the ignorance, but also the loneliness of that view. The professor presented his case as if there were no realistic alternatives to it. I intuited early on that this reflected not so much the strength of his arguments as much as a lack of the imagination.

A: A professor of fishery economics at a Norwegian business school wrote that the time had come to let Norway’s wild salmon go extinct. It may be an uneasy but inevitable choice, he wrote. The fish farming industry may be the number one threat to the wild salmon, but it had also become such an important motor of economic development that it was worth protecting at practically any cost. The loss of an entire species was a sacrifice, he suggested, that Norway absolutely should be willing to make. With my book, I wanted to stand up not only against the arrogance and the ignorance, but also the loneliness of that view. The professor presented his case as if there were no realistic alternatives to it. I intuited early on that this reflected not so much the strength of his arguments as much as a lack of the imagination.

Q: You write that “our sense of who we are as humans is mirrored in our lived relationships with other creatures.” Why, of all creatures, write about salmon?

A: Salmon, like any other-than-human creature, are a mirror in which we can seek a deeper understanding about our own humanity, and our place here inside this biosphere. They are another unique way in which the Earth imagines itself, one existential story that weaves its delicate thread into the living and breathing web of which we too are a part. At the same time, salmon now face an existential crisis both here at home in Norway and elsewhere. They may have endured ice ages; they may have survived every geological upheaval of the past few million years. But it is not yet clear whether they will be able to live through the accumulated stressors of industrial civilization.

Q: By suggesting an economy of “reciprocal obligations,” you propose a relationship in which salmon not only give gifts to humans, but one in which humans must give back to salmon. You write that salmon give us many gifts, including nutrients, nourishment, and less quantitative gifts like sense of place and community building. What can we humans give back to them?

A: The notion that salmon gift themselves to humans is widespread in many regions across the north, both among indigenous cultures in North America and also among the Sami of the Scandinavian Arctic. This understanding may be coded in language, stories, or taboos and regulations concerning fishing rights and places. There is a shared, cross-cultural understanding that we can harvest salmon in rather great quantities, and indefinitely, if we don’t become too proud. Before the fish farming industry popularized the notion that intensive farming is necessary to produce great quantities of fish, salmon were already known as a potentially superabundant staple food across the northern hemisphere. But we  also find rich documentation that if taken for granted, and if harvested greedily and carelessly, their numbers would decline—sometimes irreversibly—, and those who depended on the food would be left to face the consequences. We humans are tool-building, crafty, cunning, endlessly creative, and pioneering. All of these are double-edged qualities: On the one hand, they make us the hugely potent and adaptable top predator that we are. On the other hand, they may result in overconfidence, forgetfulness, unspeakable violence, abuse, and devastation.

also find rich documentation that if taken for granted, and if harvested greedily and carelessly, their numbers would decline—sometimes irreversibly—, and those who depended on the food would be left to face the consequences. We humans are tool-building, crafty, cunning, endlessly creative, and pioneering. All of these are double-edged qualities: On the one hand, they make us the hugely potent and adaptable top predator that we are. On the other hand, they may result in overconfidence, forgetfulness, unspeakable violence, abuse, and devastation.

So what are some of the ways in which we can make return gifts to them? First, we can gift them with careful, attentive science. Biologists are well underway to documenting the rich inner lives of fish, and ecologists are adding ever more subtleties to the story of salmon as keystone species that enrich entire landscapes, from gulls to bears to vineyards to forests. We can also gift salmon with grassroots work that helps streams regenerate and diversify. From daylighting streams to dismantling dams to planting native riverside vegetation, such work is now springing up in so many places, including Germany, where I was born and raised, and where salmon had disappeared from some rivers so thoroughly that they’d vanished even from collective memory.

Recent Articles

Garlic mustard: while known as “invasive,” this plant can be consumed in its entirety and has great nutritional value. Plus, the garlic-flavor is a perfect addition to any recipe that calls for mustard! The following are excerpts from Beyond the War on Invasive Species by Tao Orion and The Wild Wisdom of Weeds by Katrina…

Read MorePeregrine falcons, while known as predators, are essential to our environment. These stunning birds have a rich history, an interesting present, and an uncertain future. The following is an excerpt from Feather Trails by Sophie A. H. Osborn. It has been adapted for the web. Who Are Peregrine Falcons? Though relatively uncommon wherever it occurs,…

Read MoreWondering where to forage for greens this spring? Look no further than hedges, which serve as natural havens for wild greens and herbs! The following is an excerpt from Hedgelands by Christopher Hart. It has been adapted for the web. Food from Hedges: Salads and Greens Let’s start by looking at all the wild foods…

Read MoreInterested in becoming a mushroom farmer? Shiitake mushrooms are one of the easiest and most profitable places to start. The following is an excerpt from Farming the Woods by Steve Gabriel and Ken Mudge. It has been adapted for the web. (Photographs courtesy of Steve Gabriel and Ken Mudge unless otherwise noted.) The Stunning Shiitake…

Read MoreHow do you know if you’re picking the right seeds? Here are some easy tips on choosing the best seed crop for your environment. The following is an excerpt from The Organic Seed Grower by John Navazio. It has been adapted for the web. Seed Crop Characteristics There are a number of prominent characteristics of…

Read More